Retirement Planning Annual Service

Retirement planning isn’t a one-time event or a set it and forget it strategy. It’s an ongoing process that evolves as your life, markets, and tax laws change.

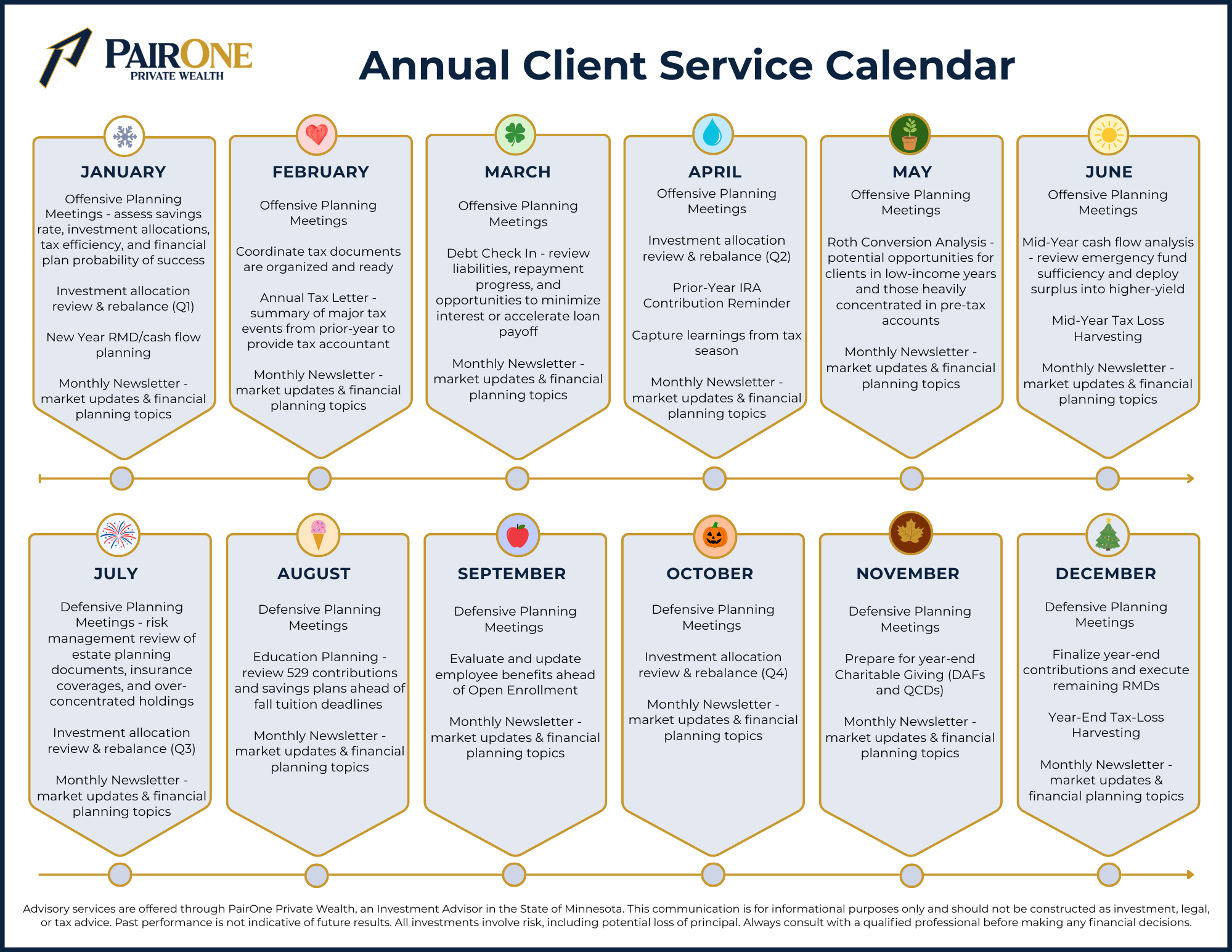

At PairOne Private Wealth, we follow a structured, proactive service calendar designed to ensure no part of your financial life is overlooked. Throughout the year, we intentionally rotate between offensive planning (building, optimizing, and taking advantage of opportunities) and defensive planning (protecting, preserving, and stress-testing your plan).

Click below to schedule an Introduction Meeting with us. Together we will explore your goals and walk through how we may support you throughout the year.

Retirement Planning

We identify and apply strategies to help you fund retirement, transition to retirement, and ensure you have adequate retirement income. Our comprehensive financial planning service incorporates a six-step planning process:

Identifying and prioritizing financial and life goals

Gathering and organizing financial data

Analyzing financial information

Proposing written recommendations

Taking action

Tracking progress

We create a personalized financial plan using MoneyGuide, a dynamic, interactive financial planning experience that helps us:

Identify and prioritize your life goals

Build a personalized, comprehensive financial plan

Consolidate and organize all your financial data in one place

Run “what-if” scenarios to test major life decisions

Stress-test your plan against market volatility, inflation, and other major risks

Plan for retirement income, taxes, insurance, education, and legacy